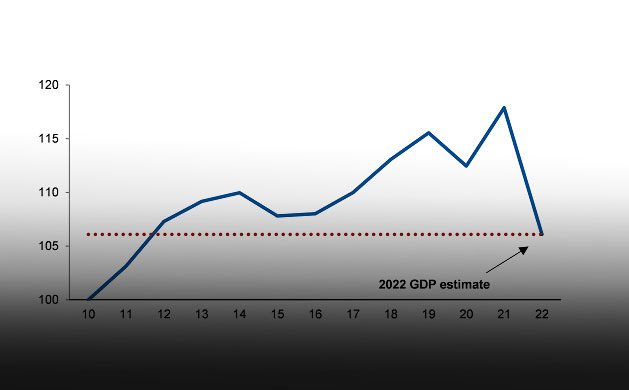

Global markets count cost of Russian invasion Ukraine war may leave lasting mark on world economy.

February 18, 2022 · Admin

The impact of Russia's invasion of Ukraine rattled global markets.

There will be lasting implica tions for commodities, energy policy and the energy transition, experts from global natural resources consultancy, Wood Mackenzie, a Verisk business, said.

count for 38% of EU demand, making sanctions on Russian flows prohibitive. But if the EU was to stop all Russian gas flows, the long-term implications could be severe.

Russia, too, would lose much. At current prices, it would give up US$7.5-bn of revenues a month, possibly more. In the tussle between Russia and the EU over gas imports, business as usual remains the most pragmatic, and likely, outcome.

The world's dependence on Russia for certain commodities cannot be overstated – from gas, coal, oil, iron ore, aluminium, platinum group metals and zinc to copper, lead, petrochemicals and fertilisers. Many major inter- national oil and gas companies, utilities and miners are invested in Russia. Wood Mackenzie's global team has analysed the risks to commodities and corporate exposure, as well as the wider economic fallout.

The invasion, though, will push the EU to question its dependency on Russian gas. New supply will take time to materialise and will see higher prices in the medium term. But LNG players in the US, Qatar and beyond are starting to gear up; as are pipe suppliers from Azerbaijan, the East Med and Norway.

Quick Enquiry

To know more about Associated Chemicals feel free to send a message

Our Sister Concerns

Our Sister Concerns

Usefull Links

Get In Touch

Assochem Chambers, Bypass, Edapally,

Kochi-682024, Kerala, India.

Phones : +91 9495999349, +91 9388610189, +91 484 2339190, +91 484 2348028

E-mail : nsn@assochem.in, marketing@assochem.in, mail@assochem.in

Support